Prekindergarten – 12th grade (PreK-12) public education funding: Probably too little or too much?

Funding public education has and will continue to be controversial as long as we breathe. Why you ask. One word – Taxes!

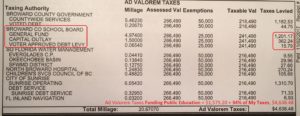

100 years ago, over 80 percent of the funding came from Local Taxes, yes, our Property Taxes. Property Taxes, also called Ad Valorem Taxes (from Latin for “according to the value”) still account for the bulk of public school funding (see my recent Tax Bill from Broward in Florida – Over 34 percent of our Property Taxes funds Broward County Public Schools).

State Sales Taxes (and may be State Income Taxes) provide the other bulk of public school funding. Due to large inequities in local taxes across neighborhoods, states jumped in to correct for the inequitable local spending (Also read the article, “School Funding: Do Poor Kids Get Their Fair Share”). We’ve all heard those West-East or North-South or Railroad Track dividers in communities across the country.

Less than 10 percent is funded by Grants from Federal agencies, like the Department of Education, Department of Agriculture’s School Lunch Program, etc. (see The Federal Role in Education).

Here’s my plea: Don’t let controversies of school funding distract you. Instead, explore how the school and you can work together to maximize your child’s learning.